2025 Heat Pump Tax Credits: Maximum Savings Guide

If you're thinking about upgrading your home's HVAC system, you may be eligible for heat pump tax credits.

In 2025, homeowners can take advantage of significant HVAC tax credits for installing energy-efficient heat pumps, reducing upfront costs on their HVAC systems. Geothermal heat pumps qualify for tax credits of up to 30% of installation costs, while air-source heat pumps can receive credits of up to $2,000. These incentives make it more affordable than ever to upgrade your home’s heating and cooling system, offering long-term cost savings and enhanced energy efficiency. If you're considering installing a heat pump, explore how these generous tax credits can help offset heat pump installation costs and boost your home's performance.

Learn more about heat pumps and explore financing options.

Available Heat Pump Tax Credits for 2025

Many heat pump tax credits are available to homeowners in 2025. The Energy Efficient Home Improvement Credit offers a 30% tax credit on the installation of energy-efficient heat pumps, with a maximum of $2,000 per year available for qualifying systems. The Section 25D credit for geothermal heat pumps provides homeowners with up to a 30% credit on installation costs for qualifying systems, with both primary and secondary homes eligible. To qualify for both credits, the system must be ENERGY STAR Most Efficient certified (a new requirement beginning in 2025), and homeowners will also need a Product Identification Number (PIN) for tax filing. In addition to these federal tax credits, homeowners may be able to access state and utility rebates, further increasing the cost savings of upgrading to energy-efficient systems like geothermal heating solutions.

Energy Efficient Home Improvement Credit (Section 25C) for 2025

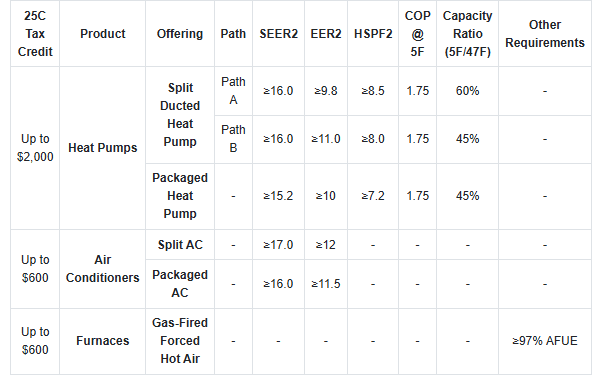

To help combat inflation, the Inflation Reduction Act of 2022 Tax Section 25C, Nonbusiness Energy Property Credit, provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $2,000 for qualified heat pumps. The 2025 Section 25C credit provides a 30% tax credit on eligible energy-efficient heat pump systems, with a $2,000 maximum per year. To qualify, the system must be ENERGY STAR Most Efficient certified, installed in a primary residence, and homeowners must obtain a Product Identification Number (PIN) for tax filing.

Geothermal Heat Pump Tax Credit: Section 25D (2025-2034)

The Section 25D credit offers a 30% tax credit for the installation of ENERGY STAR® certified geothermal heat pumps through 2032, covering both equipment and installation costs. This credit applies to both primary and secondary homes, making it accessible for a wide range of homeowners looking to upgrade to energy-efficient geothermal systems. However, the credit percentage will decrease in future years, dropping to 26% in 2033 and 22% in 2034. Learn more about geothermal heat pump systems.

Income-Based Heat Pump Rebates Up to $8,000

The High-Efficiency Electric Home Rebate Program offers rebates of up to $8,000 for the installation of energy-efficient systems, including heat pumps, in qualifying homes. To qualify, your household income must be at or below 150% of the median income for your area. This rebate can be combined with other tax credits, providing even greater cost savings for homeowners who choose to upgrade to energy-efficient systems. Check out available financing options to help pay for your heat pump.

How to Qualify for 2025 Heat Pump Tax Credits

To qualify for the 2025 heat pump tax credit, homeowners must meet several key requirements. The system must be ENERGY STAR Most Efficient certified to ensure it meets the highest efficiency standards. Additionally, the heat pump must be installed in a primary residence and not a secondary home or rental property. A Product Identification Number (PIN) is required to complete the tax filing, ensuring the system qualifies for the credit.

Homeowners will need to collect specific documentation during professional installation to claim the tax credit. This includes the manufacturer's certificate confirming the ENERGY STAR certification, installation receipts detailing the costs, and the PIN number provided for the system. These documents must be submitted when filing for the tax credit to ensure eligibility.

Claiming Your 2025 Heat Pump Tax Credit: Step-by-Step Guide

- Step 1: Determine Your Eligibility - Ensure you meet the eligibility criteria.

- Step 2: Gather Necessary Documentation - Collect all receipts, invoices, and manufacturer certifications as proof of purchase and eligibility.

- Step 3: Complete IRS Form 5695 - This form is specifically for claiming the residential energy-efficient property credit.

- Step 4: Submit Your Tax Return - Include Form 5695 when filing your federal tax return.

| Line Item | $ |

| Heat Pump | $2,250 |

| Labor/Installation | $750 |

| Total Cost | $3000 |

| Tax Credit (30% of cost) | $900 |

| Cost Less Credit | $2,100 |

Additional Heat Pump Savings: Local Utility Rebates

Utility rebates can be combined with federal tax credits to maximize savings on your heat pump purchase, significantly reducing overall heat pump installation costs. For example, you might qualify for up to $2,000 in tax credits for an air-source heat pump, plus an additional rebate of $500 to $1,500 from your utility provider, depending on your location and the system model. Since rebate amounts vary, it's crucial to check current offers in your area and for the specific qualifying systems you’re considering to ensure you’re taking full advantage of all available cost savings.

Get Expert Help With Heat Pump Tax Credits

Working with a Carrier Authorized Dealer ensures you’re getting expert guidance on the 2025 heat pump tax credit requirements and how to maximize available incentives. Carrier offers many qualifying systems, and your local Carrier dealer is well-versed in the tax credits, rebates, and financing options that can help reduce your installation costs. By choosing a Carrier dealer for professional installation of energy efficient heat pumps, you’re not only ensuring a high-quality system but also taking full advantage of the financial incentives available to make your energy-efficient upgrade more affordable. Find a qualified Carrier dealer today.

Frequently Asked Questions About Heat Pump Tax Credits

Learn More About Heat Pumps

- Let's start with the basics - What is a Heat Pump?

- Learn the difference between Heat Pumps vs Air Conditioning

- Explore Heat pump Service

- Learn about Heat Pump Efficiency and SEER Ratings

- 3 Reasons To Consider A Heat Pump

- Heat Pumps: A Sustainable Comfort Solution